Recent biotech news from Wall Street is optimistic, providing some much-needed hope for lab supply vendors, who have endured weakened sales and heavy investments in manufacturing over the past two years. While suppliers typically opt for cost control methods to avoid passing on price increases to the customer, a confluence of factors has caused them to buck tradition and raise prices. In its wake, professionals in lab operations, finance, and procurement must remain vigilant of changing market conditions and seek more efficient lab supply purchasing solutions.

To help guide procurement strategies for the remainder of 2024 and beyond, ZAGENO’s webinar, How to Optimize Lab Supply Spend & Foster Supplier Competition, offered procurement leaders, lab managers, and finance decision-makers access to exclusive data gleaned from hundreds of thousands of biotech and pharma lab supply purchases made through the ZAGENO marketplace.

Note on this article’s data source: As the leading lab supply marketplace, ZAGENO serves as the Amazon of the life sciences industry, covering 5,300+ brands and 40 million+ different product SKUs. The breadth and depth of products offered provide ZAGENO with unique insights into best practices and changing market conditions, empowering R&D to make informed lab supply purchases that enable both resource optimization and scientific choice.

Biotech industry trends affecting lab supply pricing

A number of industry trends, as well as monetary inflation and deflation of raw materials, are currently at play in the lab supply market. Due to inventory shortages during the COVID-19 pandemic, suppliers ramped up their manufacturing capabilities to meet increased demand. However, these investments came at the cost of supply chain and technology improvement initiatives. Unfortunately, the surge in inventory levels coincided with a softening of sales stemming from the downturn in the biotech industry, leaving suppliers grappling to meet their targets.

| Biotech industry trends affecting lab supply pricing in 2024 | ||

| ↑ | Manufacturing | Investments during COVID led to increased manufacturing capabilities from most suppliers. |

| ↑ | Inventory | Increased manufacturing and slowing demand left many suppliers with excess inventory. |

| → | Supply Chain | There are some stand-out supply chains, but, overall, improvement is needed industry-wide. |

| → | Technical Capabilities | Investments going into manufacturing and warehousing tech improvements have stalled. |

| → | Customer & Technical Support | Suppliers ramped up staffing during COVID but have since normalized due to reduced demand. |

| ↓ | Sales | Suppliers have experienced a softening in sales coming off record years during COVID. |

Supplier price increases across portfolios

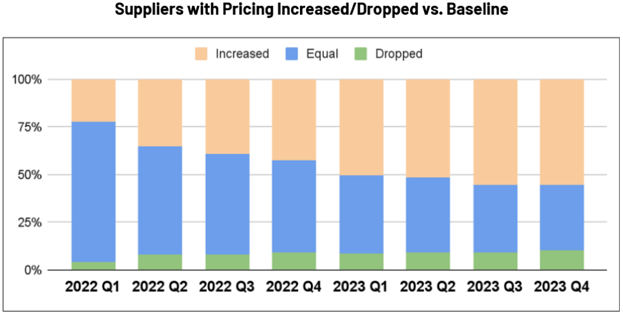

Historically, suppliers have been reluctant to implement too many price increases. However, beginning in Q1 2022, suppliers began distributing price increases across a larger portion of their portfolio, with around 25% seeing slight increases and a smaller portion experiencing moderate adjustments.

By the end of 2023, ZAGENO observed a more noticeable shift, with price increases touching more than 50% of suppliers’ portfolios, as suppliers began to use pricing to manage inflation and sluggish sales. While not dramatic, these increases still signify an industry shift with serious implications for customers.

Less aggressive supplier pricing in 2023

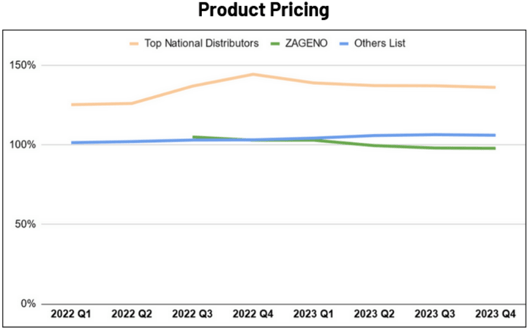

Suppliers on the ZAGENO platform have generally maintained stable pricing, with most adjustments hovering at 5% or less across the entire portfolio.

Conversely, the top national distributors substantially raised prices in 2022 beyond the market average. In 2023, they began to reduce prices, though not at the market rate. Further, the gap between customer-specific prices offered by the top national distributors and their list prices has been gradually closing.

Steadier shipping costs in 2023

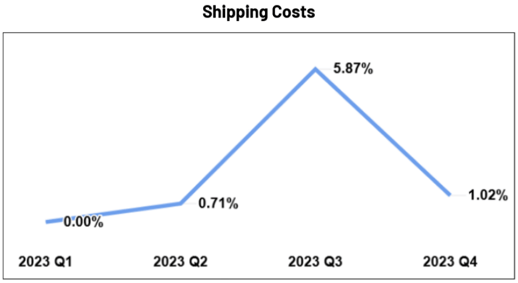

Prior to the COVID-19 pandemic, it was common practice for suppliers to include shipping costs in a product’s price. This changed significantly during the pandemic as additional charges emerged, such as handling fees, fuel surcharges, and special fees. Though some of these extra charges began to fade in 2022, shipping costs still increased considerably in that time.

The situation stabilized during 2023, with no significant increases. Shipping costs did slightly increase in Q3 2023 due to the resurgence of capital expenditure (CAPEX) orders, which often incur high shipping expenses. Nevertheless, it's reassuring to note that there have been no significant fluctuations observed in shipping costs throughout 2023 and the beginning of 2024.

CAPEX spend recovery

CAPEX spend is another indicator monitored by ZAGENO to gauge overall market health. Analysis indicates that the market bottomed out in Q4 2022 and Q1 2023, followed by a modest recovery throughout 2023. Early indicators in 2024 suggest a continued upward trend.

A resurgence in CAPEX spending, such as what is being observed now, typically indicates that biotech companies are becoming more comfortable with increased spend or have secured additional funding.

Lab supply market share trends

Biggest 2023 market share winners. 2023 marked a significant shift in terms of ZAGENO market share winners. Customers increasingly purchased from larger, well-integrated, competitively priced, quality-driven brands with strong service level agreements (SLAs). Interestingly, customers report that these products are often easier to find on the ZAGENO platform compared to others. This finding aligns with the fact that ZAGENO doesn't offer private labels, which other platforms typically favor in search results via search engine optimization.

Biggest 2023 market share losers. ZAGENO observed some of the top national distributors experiencing a significant decline in sales across the platform, with a portion of the decline attributable to customers opting for larger brands over private labels. Certain non-distributor suppliers were also impacted, albeit to a lesser extent. Despite having strong brand recognition, some of these suppliers encountered heightened competition from alternatives offering similar or even superior quality products at more competitive prices.

How lab supply marketplaces offer an effective solution in times of rising prices

Lab supply marketplaces, such as ZAGENO, are dedicated to accelerating research by offering a streamlined solution to shop, track, and manage lab supplies. ZAGENO's services create value by reducing overhead costs and maximizing efficiency and time savings, as well collaborating with supplier partners to ensure competitive pricing.

Using metrics to demonstrate customer behavior within the platform, ZAGENO works with suppliers to lower prices more effectively, resulting in the majority of products being priced below list price. Such strategic price adjustments underscore suppliers' recognition of the marketplace's competitive value. Additionally, in the absence of private label offerings, ZAGENO’s AI-driven search highlights products with similar quality and specifications, often at more favorable price points. Such price transparency empowers customers to identify inflated list prices, which is especially critical during periods of higher pricing fluctuations.

ZAGENO remains committed to nurturing both customer and supplier partnerships by sharing marketplace performance insights, industry trends, and best practices. Take a deeper dive into how to optimize lab supply spend and foster supplier competition with our free eBook, How to Optimize Lab Supply Spend and Foster Supplier Competition.